The study and its scope

Twelve waste collection systems (WCS) across Europe were assessed from a financial perspective conducted by means of a Cost Benefit Analysis (CBA). These included 5 paper and packaging waste (PPW) cases, 5 waste electrical and electronic equipment (WEEE) cases and 2 construction and demolition waste (CDW) cases. The full report can be found in this report.

Shifting to separate waste collection

Costs and revenues for waste collection are to a large extent a function of the quantities and qualities of the waste, as well as the waste collection system in place. Ideally, such parameters could be used to draw conclusions about the cost effectiveness of a waste collection system. However, comparing collection systems and drawing conclusions on the performance is complex, given the often different regional characteristics, underlying interpretations and assumptions of costs and benefits.

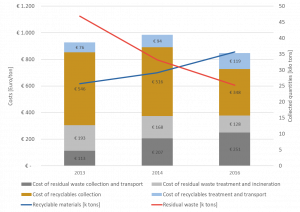

For the Parma case, it was possible to provide such an insight in the financial shift from comingled collection, incineration and landfilling to more separate collection and recycling between 2013 and 2014. Data for 2013, 2014 and 2016 is available. Based on the technical collection costs directly paid by the municipality, the cost per tonne of waste were calculated. The operational costs are presented by the bars (left axis), and the corresponding waste volumes are shown by the lines (right axis). Based on this graph it was found that with dropping volumes residual waste the collection cost increases and the treatment cost decreases, whereas for increasing volumes of recyclables waste, the collection cost decreases and treatment cost increase.

High performance vs balancing the costs and benefits

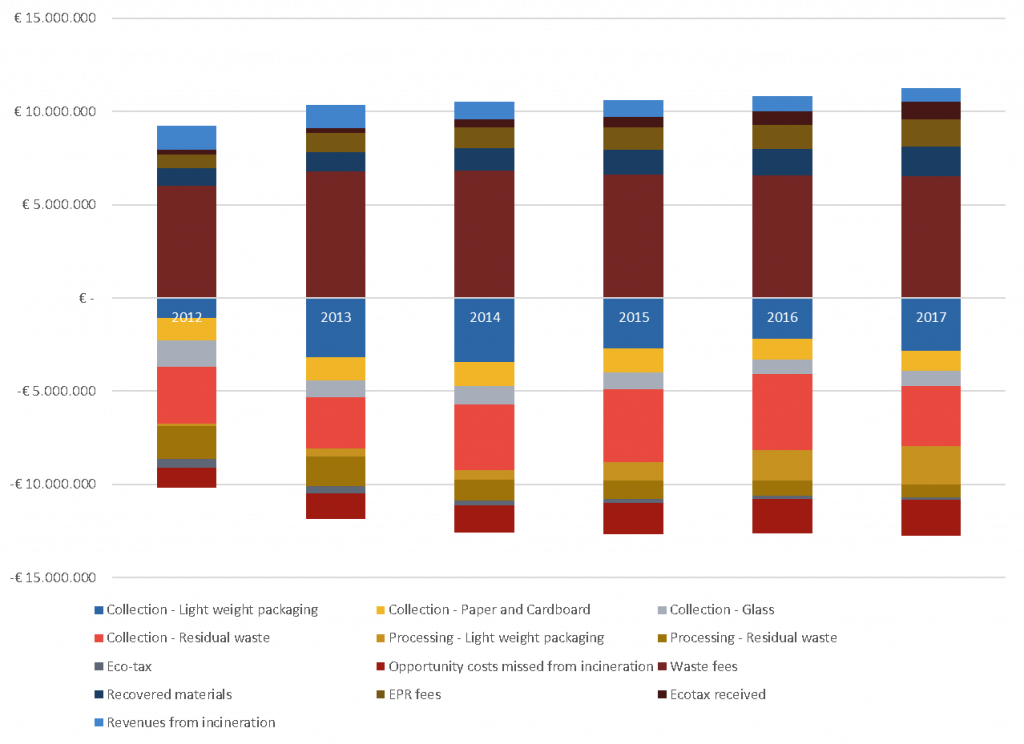

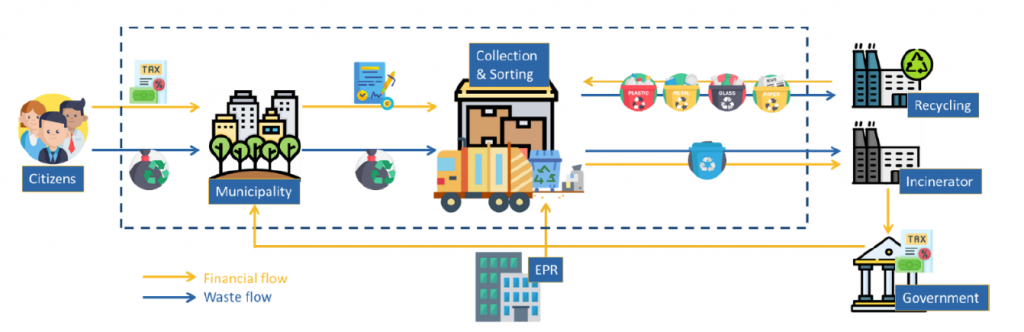

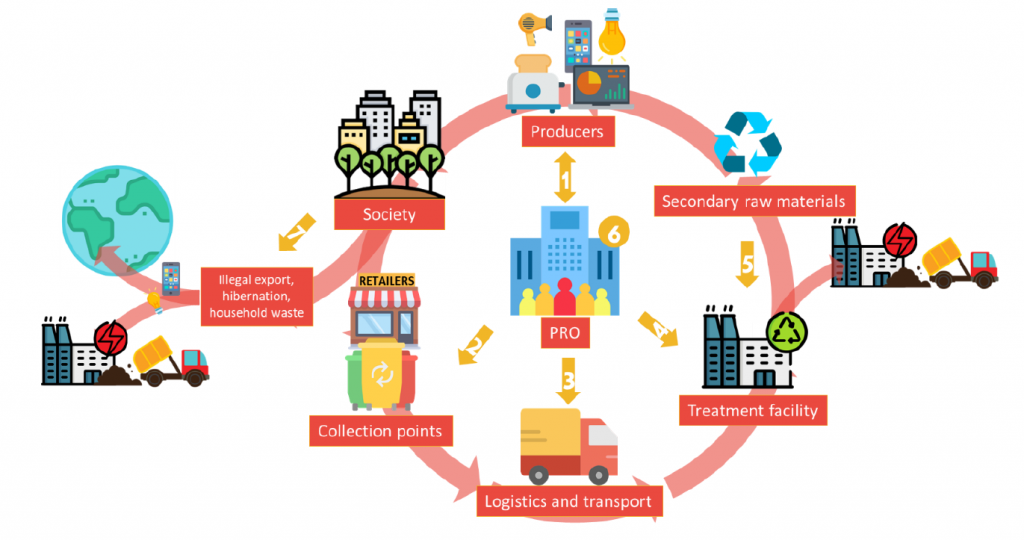

Overall, it was found that it is possible for municipalities to achieve high performing separate waste collection while balancing the costs and benefits. For PPW, largely financed through the citizen waste tax this means that it is possible to maintain acceptable fees for citizens. The figure below shows all costs (-) and revenues(+) identified for the Parma case; indicating that both the total operational costs for separate collection and the revenues increase. However, local authorities are largely dependent on national incentives such as financial contributions from EPR schemes, revenues from sold materials and tax savings or incentives, and not all cases resulted in a positive business case. For WEEE, collection, logistics and treatment is financed largely through the PRO fee, paid by producers when putting electronic products on the market. The case studies showed that PRO’s managed to increase their collected quantities despite decreasing PRO fees due to growing competition and collection challenges such as scavenging and illegal export. For CDW it is concluded that while separate collection systems can be introduced relatively easily and without large investments, they are largely dependent on the local recycling value chain. From the municipal point of view, transport costs and gate fees seem to be the two crucial parameters.

The individual case results and details for all 12 studies are provided in the report.